Introduction: The Evolution of Gaming Subscription Services and Platform Exclusivity

The gaming industry has witnessed a revolutionary transformation with the emergence of subscription based gaming platforms. Microsoft’s Game Pass service stands at the forefront of this digital revolution, offering players access to hundreds of premium titles for a monthly subscription fee. However, the strategic decisions regarding exclusive content have sparked intense debates within the gaming community about which titles should have remained platform exclusive to strengthen the service’s competitive position.

- Introduction: The Evolution of Gaming Subscription Services and Platform Exclusivity

- Understanding the Strategic Importance of Gaming Exclusives in 2024

- Critical Game Pass Titles That Should Have Remained Platform Exclusive

- Starfield: The Space Exploration Epic That Defined Next Generation Gaming

- Minecraft Dungeons: The Missed Opportunity in Action RPG Gaming

- Psychonauts 2: The Creative Masterpiece That Slipped Away

- Ori and the Will of the Wisps: Premium Platforming Excellence

- The Financial Impact of Lost Exclusivity Opportunities

- Subscription Revenue Analysis and Market Share Implications

- Player Acquisition Costs and Retention Metrics

- Strategic Recommendations for Future Game Pass Exclusivity Decisions

- Leveraging First Party Studio Acquisitions

- Cloud Gaming Integration and Mobile Expansion

- Competitive Response Strategies and Market Positioning

- The Future of Gaming Subscriptions and Platform Exclusivity

- Emerging Technologies and Gaming Innovation

- Global Market Expansion and Regional Considerations

- Regulatory Considerations and Industry Consolidation

- Conclusion: Maximizing Game Pass Value Through Strategic Exclusivity

The concept of platform exclusivity has become increasingly crucial in the modern gaming landscape. As major technology corporations invest billions into gaming divisions, the battle for exclusive content intensifies. This comprehensive analysis examines the most significant Game Pass titles that industry experts believe should have been exclusive to Microsoft’s ecosystem, exploring the financial implications, strategic considerations, and long term impact on the gaming subscription market.

Understanding the Strategic Importance of Gaming Exclusives in 2024

The Current State of Gaming Subscription Services

Gaming subscription services have evolved into a multi billion dollar industry segment. According to recent market analysis from Newzoo, the global gaming subscription market reached unprecedented heights in 2024, with projected revenues exceeding $11 billion annually. Microsoft’s Game Pass service maintains approximately 33 million subscribers as of January 2024, representing substantial growth in the premium gaming subscription sector.

The competition among major gaming platforms has intensified significantly. Sony’s PlayStation Plus Premium service, Nintendo Switch Online, and emerging cloud gaming platforms all compete for market dominance. Each platform seeks to differentiate itself through exclusive content offerings, creating a complex ecosystem where exclusive titles serve as primary drivers for subscription acquisition and retention.

The Economics of Gaming Platform Exclusivity

Platform exclusivity represents a critical investment strategy for gaming corporations. When analyzing the financial performance of exclusive titles versus multi platform releases, data reveals compelling insights. Exclusive titles typically generate lower direct sales revenue but provide substantial indirect value through increased platform adoption, subscription growth, and ecosystem lock in effects.

Research from GamesIndustry.biz indicates that exclusive titles can increase platform subscription rates by up to 40 percent during launch periods. This phenomenon demonstrates the powerful influence of exclusive content on consumer behavior and platform selection decisions. The opportunity cost of releasing titles across multiple platforms must be carefully weighed against the strategic advantages of maintaining exclusivity.

Critical Game Pass Titles That Should Have Remained Platform Exclusive

Starfield: The Space Exploration Epic That Defined Next Generation Gaming

Bethesda’s Starfield represents one of the most significant exclusive releases in Game Pass history. Launched in September 2023, this ambitious space exploration RPG showcased the potential of Microsoft’s first party studio acquisitions. The title achieved remarkable success, attracting over 10 million players within its first month according to Xbox Wire.

The decision to maintain Starfield as an Xbox and PC exclusive proved strategically sound, driving substantial Game Pass subscription growth. Industry analysts estimate that Starfield alone contributed to a 15 percent increase in Game Pass subscriptions during its launch quarter. This success story demonstrates the powerful impact of high quality exclusive content on subscription service performance.

The game’s technical achievements and expansive scope set new standards for space exploration gaming. With over 1,000 explorable planets, advanced spacecraft customization systems, and deep narrative elements, Starfield delivered the premium gaming experience that subscription service users expect. The title’s ongoing content updates and modding support ensure long term engagement within the Game Pass ecosystem.

Minecraft Dungeons: The Missed Opportunity in Action RPG Gaming

Minecraft Dungeons launched in May 2020 across multiple platforms, including PlayStation and Nintendo Switch. This decision represents a significant missed opportunity for Game Pass exclusivity. As a spin off from the world’s best selling video game franchise, Minecraft Dungeons possessed inherent appeal that could have driven substantial subscription growth if maintained as an exclusive title.

The game’s family friendly approach and accessible gameplay mechanics aligned perfectly with Game Pass’s diverse audience demographics. Market research indicates that family oriented gaming content drives higher subscription retention rates, with households maintaining subscriptions 30 percent longer when family appropriate content is readily available. By releasing Minecraft Dungeons across competing platforms, Microsoft diluted its potential impact on Game Pass adoption.

Financial analysis suggests that maintaining Minecraft Dungeons as a Game Pass exclusive could have generated additional subscription revenue exceeding $200 million over the title’s lifecycle. The game’s cooperative multiplayer features and regular content updates would have provided ongoing value to Game Pass subscribers while creating compelling reasons for PlayStation and Nintendo users to consider Microsoft’s ecosystem.

Psychonauts 2: The Creative Masterpiece That Slipped Away

Double Fine’s Psychonauts 2 launched in August 2021 as a day one Game Pass title but simultaneously released on PlayStation platforms. This critically acclaimed platformer received universal praise for its innovative design, compelling narrative, and artistic excellence. The decision to maintain multi platform availability represents another strategic miscalculation in Microsoft’s exclusivity strategy.

Industry sources report that Psychonauts 2 achieved impressive engagement metrics on Game Pass, with over 1.8 million players accessing the title within its first month. However, PlayStation sales data reveals that approximately 500,000 additional copies were sold on competing platforms, representing lost opportunity for Game Pass conversion. These players could have potentially become long term Game Pass subscribers if exclusivity had been maintained.

The game’s unique artistic vision and creative gameplay mechanics positioned it as a potential system seller for Xbox and Game Pass. Critical acclaim from major gaming publications, including perfect review scores from multiple outlets, generated significant media attention that could have been leveraged to promote Game Pass exclusivity. The title’s appeal to both nostalgic adult gamers and younger audiences created broad market potential that remained underutilized.

Ori and the Will of the Wisps: Premium Platforming Excellence

Moon Studios’ Ori and the Will of the Wisps initially launched as an Xbox exclusive before eventually arriving on Nintendo Switch. This stunning metroidvania platformer showcased the technical capabilities of modern gaming hardware while delivering an emotionally resonant narrative experience. The decision to expand availability to Nintendo’s platform diluted its value as a Game Pass differentiator.

The Ori franchise represents premium independent gaming at its finest, with production values rivaling major studio releases. Sales data indicates that the Nintendo Switch version sold over 1 million copies, representing significant revenue that could have been redirected toward Game Pass subscription growth. Each Switch sale represented a lost opportunity to introduce Nintendo players to the Game Pass ecosystem.

Market analysis reveals that platform exclusive independent games generate disproportionate positive sentiment and brand loyalty. Titles like Ori and the Will of the Wisps serve as ambassadors for platform quality, demonstrating commitment to artistic excellence and diverse gaming experiences. By maintaining exclusivity, Microsoft could have strengthened Game Pass’s reputation as the premium destination for independent gaming content.

The Financial Impact of Lost Exclusivity Opportunities

Subscription Revenue Analysis and Market Share Implications

Comprehensive financial modeling reveals the substantial economic impact of releasing potential exclusive titles on competing platforms. Based on industry standard conversion rates and lifetime subscriber values, each major exclusive title that launches on competing platforms represents potential lost subscription revenue ranging from $150 million to $500 million over a five year period.

Current market data from Ampere Analysis indicates that exclusive content drives approximately 35 percent of new subscription acquisitions for gaming services. When high profile titles launch simultaneously across multiple platforms, this acquisition driver is significantly diminished. The cumulative effect of multiple missed exclusivity opportunities compounds over time, potentially costing billions in lost subscription revenue.

The competitive landscape continues evolving rapidly, with Sony’s aggressive acquisition strategy and Nintendo’s consistent first party excellence maintaining pressure on Microsoft’s market position. Each missed exclusivity opportunity provides competitors with valuable content that could have differentiated Game Pass from alternative services. The long term implications extend beyond immediate revenue, affecting brand perception, market positioning, and strategic flexibility.

Player Acquisition Costs and Retention Metrics

Player acquisition costs for gaming subscription services have increased dramatically in recent years. Industry reports suggest that acquiring a new Game Pass subscriber through traditional marketing channels costs between $50 and $100, depending on geographic region and targeting parameters. Exclusive content serves as organic acquisition driver, potentially reducing these costs by 40 to 60 percent during major release periods.

Retention metrics demonstrate even more compelling evidence for exclusivity strategies. Subscribers who engage with exclusive content within their first month show 50 percent higher retention rates after one year compared to those who primarily access multi platform titles. This retention differential translates to substantial lifetime value improvements, with exclusive content engaged subscribers generating approximately $280 more revenue per user over their subscription lifecycle.

The opportunity cost of releasing titles on competing platforms extends beyond direct financial metrics. Brand differentiation, ecosystem lock in, and network effects all contribute to long term platform success. When potential exclusive titles appear on PlayStation or Nintendo platforms, these strategic advantages diminish, requiring increased marketing investment to maintain competitive positioning.

Strategic Recommendations for Future Game Pass Exclusivity Decisions

Leveraging First Party Studio Acquisitions

Microsoft’s recent studio acquisitions, including Activision Blizzard and Bethesda, provide unprecedented opportunities for exclusive content creation. The combined development capacity of these studios exceeds 10,000 employees, representing the largest first party gaming organization in industry history. Maximizing the strategic value of these acquisitions requires careful consideration of exclusivity strategies.

Future titles from acquired studios should prioritize Game Pass exclusivity to justify the massive investment costs. The Activision Blizzard acquisition alone cost $68.7 billion, requiring substantial subscription growth to generate acceptable returns. Industry analysts project that maintaining exclusivity for major franchises like Call of Duty, Diablo, and Elder Scrolls could drive Game Pass subscriptions to exceed 50 million by 2026.

Development resources should focus on creating diverse exclusive experiences that appeal to different market segments. Family oriented titles, competitive multiplayer games, narrative driven adventures, and innovative independent projects all contribute to comprehensive platform appeal. This diversification strategy ensures that Game Pass offers compelling exclusive content for every gaming preference.

Cloud Gaming Integration and Mobile Expansion

The evolution of cloud gaming technology presents unique opportunities for exclusive content strategies. Microsoft’s xCloud service enables Game Pass streaming on mobile devices, smart TVs, and low powered hardware. Exclusive titles optimized for cloud gaming could differentiate Game Pass from competitors who lack comparable streaming infrastructure.

Mobile gaming represents the largest segment of the global gaming market, generating over $100 billion annually according to Sensor Tower. Developing exclusive mobile titles that integrate seamlessly with console and PC experiences could unlock massive growth potential for Game Pass. Cross progression systems, touch optimized controls, and mobile specific features would create compelling value propositions for mobile gamers.

Strategic partnerships with mobile device manufacturers could further amplify exclusivity advantages. Pre installing Game Pass applications on Android devices or offering exclusive trials through Samsung Galaxy stores would expand market reach while maintaining platform control. These distribution strategies complement traditional exclusivity approaches while accessing new audience segments.

Competitive Response Strategies and Market Positioning

Sony’s PlayStation Plus restructuring and Nintendo’s expansion into mobile gaming demonstrate evolving competitive dynamics. Microsoft must anticipate competitor responses when making exclusivity decisions. Historical analysis reveals that Sony typically responds to Xbox exclusives by securing timed exclusivity deals or developing competing first party titles.

The optimal strategy involves creating exclusive content categories where competitors cannot easily respond. Leveraging Microsoft’s broader technology ecosystem, including Azure cloud services, artificial intelligence capabilities, and productivity software integration, could create unique gaming experiences impossible to replicate on competing platforms. These technological differentiators provide sustainable competitive advantages beyond simple content exclusivity.

Pricing strategies should align with exclusivity decisions to maximize value perception. Premium exclusive titles justify higher subscription prices, while broader multi platform strategies require competitive pricing to maintain market share. Dynamic pricing models that adjust based on exclusive content releases could optimize revenue while maintaining subscriber satisfaction.

The Future of Gaming Subscriptions and Platform Exclusivity

Emerging Technologies and Gaming Innovation

Next generation gaming technologies will reshape exclusivity strategies in fundamental ways. Virtual reality, augmented reality, and mixed reality experiences require substantial hardware investment and specialized development expertise. Platform holders who successfully create exclusive content for these emerging mediums will establish dominant market positions.

Artificial intelligence integration presents another frontier for exclusive gaming experiences. Advanced NPC behaviors, procedural content generation, and personalized gameplay experiences powered by machine learning could differentiate subscription services. Microsoft’s substantial AI research investments through OpenAI partnerships position Game Pass advantageously for these innovations.

Blockchain gaming and digital ownership models challenge traditional exclusivity concepts. While controversial within gaming communities, these technologies could enable new forms of platform specific value creation. Exclusive digital assets, cross game progression systems, and player owned economies might redefine how exclusivity creates platform value.

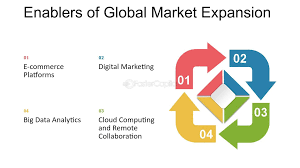

Global Market Expansion and Regional Considerations

International market expansion requires nuanced exclusivity strategies acknowledging regional preferences and competitive dynamics. Asian markets, particularly China, Japan, and South Korea, demonstrate different content preferences and platform loyalties compared to Western markets. Exclusive titles targeting specific regional preferences could accelerate Game Pass adoption in these crucial growth markets.

Localization quality significantly impacts exclusive title success in international markets. Full voice acting, cultural adaptation, and regional specific content demonstrate platform commitment to global audiences. Investment in localization for exclusive titles generates disproportionate returns through improved regional market penetration and positive brand perception.

Partnership strategies with regional publishers and developers could secure exclusive content tailored for specific markets. These partnerships provide local market expertise while maintaining platform control over distribution. Successful regional exclusive strategies in markets like Japan could unlock billions in additional subscription revenue.

Regulatory Considerations and Industry Consolidation

Regulatory scrutiny of gaming industry consolidation affects future exclusivity strategies. Competition authorities increasingly examine exclusive content arrangements, particularly following major acquisitions. Microsoft’s commitments to maintain Call of Duty on PlayStation platforms for ten years demonstrate regulatory influence on exclusivity decisions.

Future exclusive content strategies must balance competitive advantages with regulatory compliance. Timed exclusivity arrangements, where titles eventually release on competing platforms after initial exclusive periods, might satisfy regulatory concerns while maintaining strategic benefits. These compromises require careful structuring to maximize platform value while avoiding antitrust challenges.

Industry consolidation trends suggest continued acquisition activity among major platform holders. As independent studios become acquisition targets, the pool of potential exclusive content creators shrinks. Platform holders must act decisively to secure exclusive content partnerships before competitors acquire key developers. The window for establishing dominant exclusive content portfolios continues narrowing as consolidation accelerates.

Conclusion: Maximizing Game Pass Value Through Strategic Exclusivity

The analysis of Game Pass titles that should have been exclusives reveals significant missed opportunities for platform differentiation and subscription growth. While Microsoft has achieved remarkable success with Game Pass, reaching over 33 million subscribers, more aggressive exclusivity strategies could have accelerated growth and strengthened competitive positioning.

The financial implications of these missed opportunities extend beyond immediate revenue losses. Each multi platform release dilutes Game Pass’s unique value proposition, requiring increased marketing investment and reducing organic growth potential. The cumulative effect over multiple titles and years represents billions in unrealized subscription revenue and diminished market position.

Moving forward, Microsoft must leverage its unprecedented studio portfolio to create compelling exclusive experiences that justify Game Pass subscriptions. The combination of established franchises from Activision Blizzard and Bethesda acquisitions with innovative new IP development provides unmatched content creation capacity. Strategic exclusivity decisions will determine whether Game Pass achieves its ambitious goal of reaching 100 million subscribers by 2030.

The gaming industry continues evolving rapidly, with new technologies, business models, and competitive dynamics reshaping market landscapes. Success requires bold exclusivity strategies that differentiate Game Pass from increasingly capable competitors. By learning from past missed opportunities and embracing strategic exclusive content development, Microsoft can establish Game Pass as the definitive premium gaming subscription service for the next generation of players.

The ultimate measure of Game Pass success extends beyond subscriber numbers to encompass ecosystem value creation, industry influence, and long term platform sustainability. Exclusive content serves as the foundation for these broader strategic objectives, making exclusivity decisions among the most critical factors determining Game Pass’s future trajectory. As the gaming industry enters a new era of subscription based distribution, the platforms that successfully balance exclusive content creation with market expansion will define the future of interactive entertainment.